installment open end credit example

An auto loan is an installment loan that is borrowed in order to purchase a motor vehicle. Open end credit.

Understanding Different Types Of Credit Nextadvisor With Time

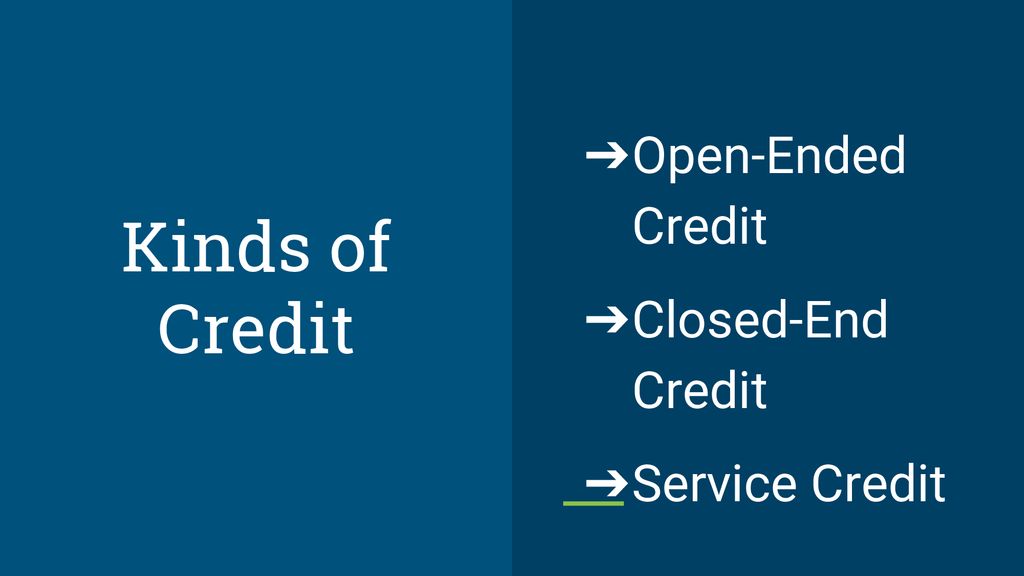

The 3 main types of credit are revolving credit installment and open credit.

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

. Which of the following is an example of open-end credit. Credit cards and open end credit are very similar because the borrower controls how much to borrow. Installment loans are made directly to customers for activities such as buying automobiles boats or recreational vehicles.

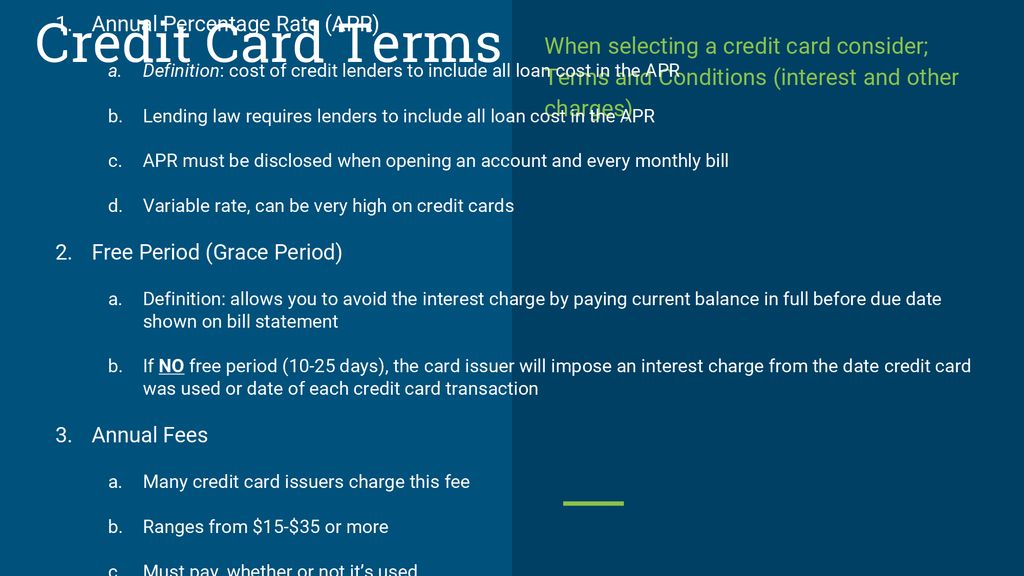

Closed end credit is offered by financial institutions often referred to it as an installment loan or a secured loan. Common examples of open-end credit are credit cards and lines of credit. B the mortgage loan from a savings and loan institution.

Open end loan can be borrowed multiple times. A written agreement should be made between lender and borrower. An example of this would be a cellphone bill you can make phone calls.

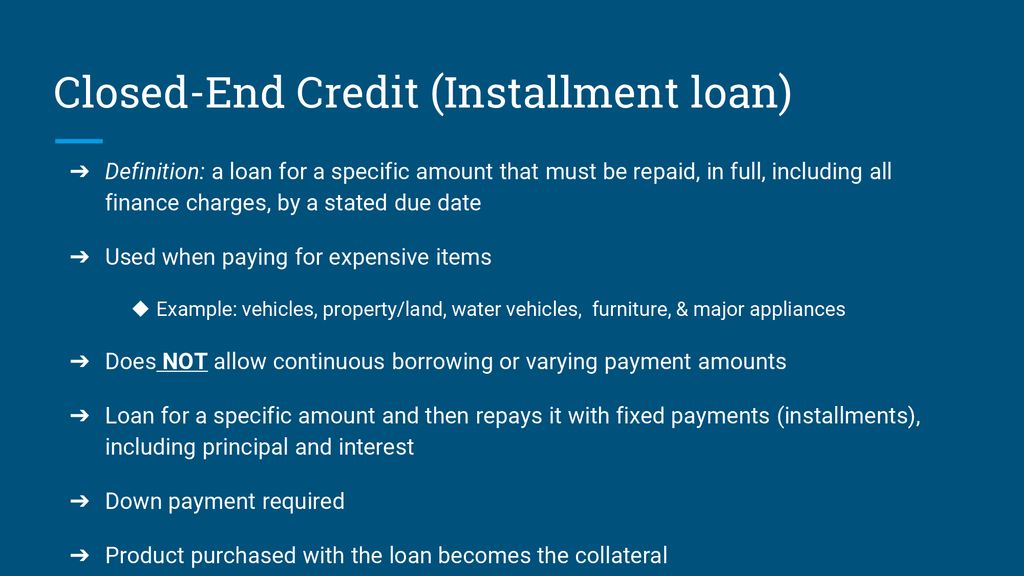

With a closed-end loan you borrow a specific amount of money for a. Which of the following is an example of a conventional mortgage. In the agreement the total amount of loan interest rate the length of the repayment time and the monthly payments should be mentioned.

An FHA mortgage b. Installment credit is also known as closed-end credit. Study with Quizlet and memorize flashcards terms like A good example of an open-end credit is.

C automobile loan from a credit union. As you repay what youve borrowed you can draw from the credit line again and again. A secured credit card and home equity line.

A good example of an open-end credit is A. Some examples of open-end credit loans are credit cards home equity lines of credit HELOC and a personal line of credit. However the primary form of mortgage in the US is the closed-end mortgage.

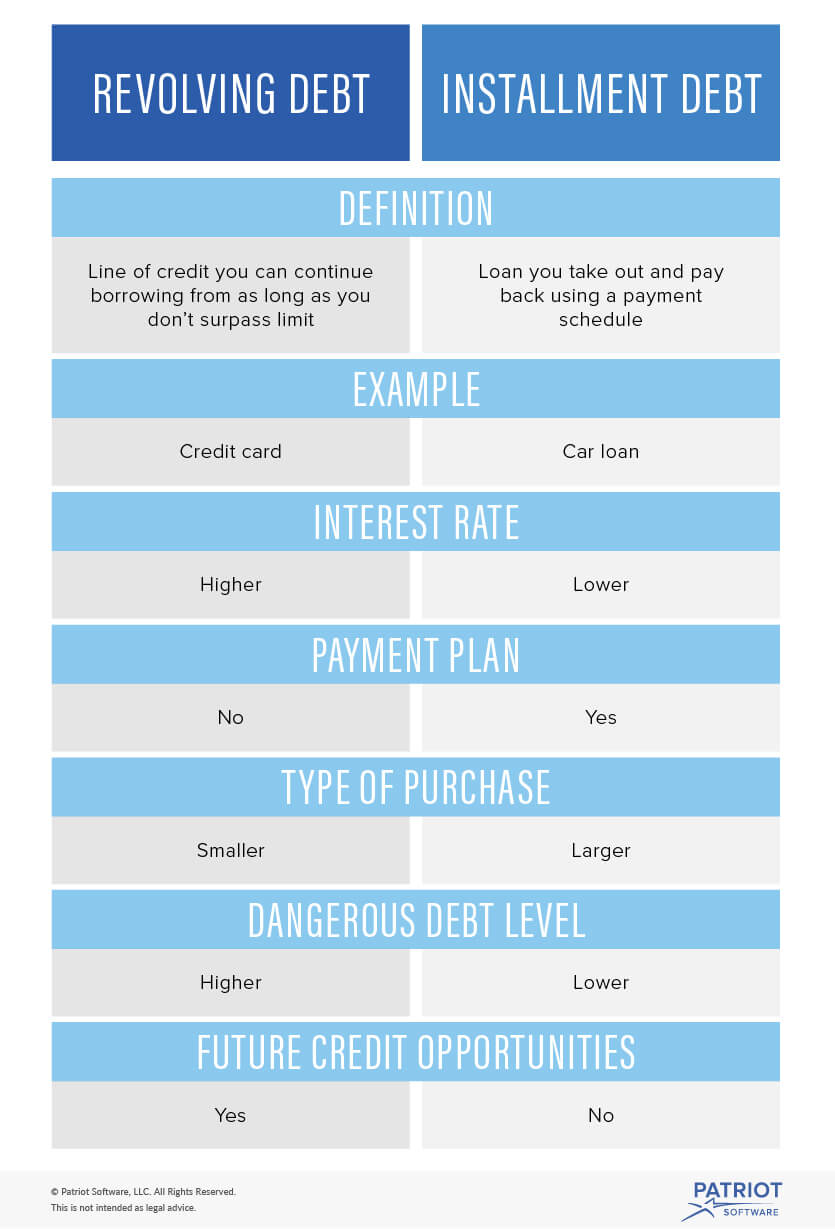

You will borrow a single sum and be responsible for paying it back over a period of time. D installment loan for purchasing a major appliance. Credit cards are the most common type of revolving credit but HELOC home equity line of credit loans are another example.

When you take out an installment loan you borrow a fixed sum of money and make monthly payments of a specific amount until the loan is paid off. A fixed rate mortgage d. Installment loan for purchasing a major appliance.

H-17A Debt Suspension Model Clause. Once your loan is paid off the account closes. A secured open-end loan is a line of credit thats secured by or attached to a piece of collateral.

Regulation Z is structured accordingly. Heres what you need to know about installment loans how they work and how they affect your credit. A banks installment lending portfolio is usually comprised of secured or unsecured small loans each scheduled to be repaid in equal installments at fixed intervals over a specific period closed-end loans.

Installment loan from a furniture store. To better understand open-end credit it helps to know what closed-end credit means. Automobile loan from a credit union.

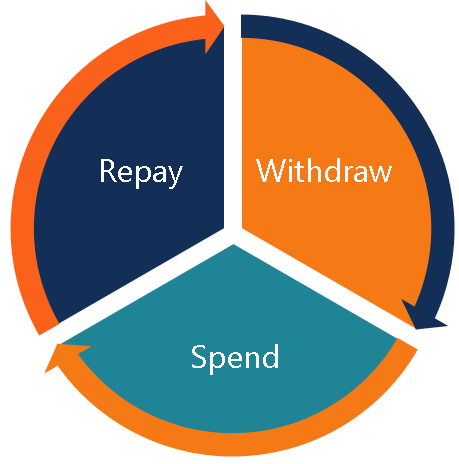

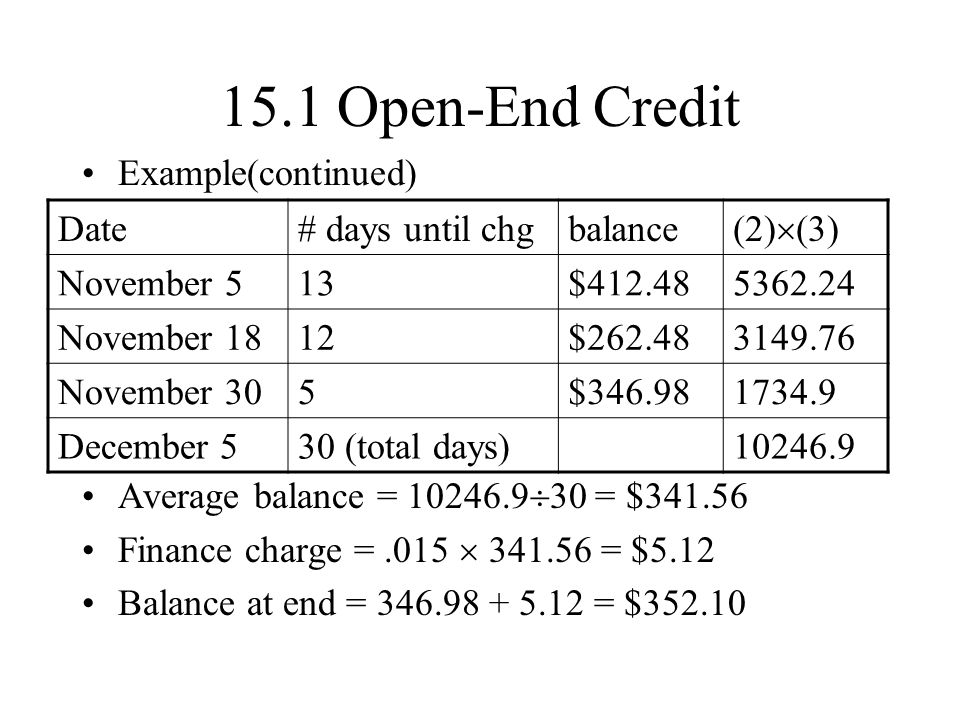

Installment loan from a furniture store. Open-end credit also called revolving credit can be defined as a line of credit that gives the borrower a certain limit of credit and the ability to frequently borrow as little or as much of that money and repay any amount utilized below the set limit within a specified period. Installment Loans and Open-End Credit Mindie Hunsaker is thinking about buying a car and getting a 3-year loan from her bank in the amount of 7200.

An installment loan can have a repayment period of months or years. Automobile loan from a credit union. Similar to a credit card limit but you are required to pay the funds borrowed in full at the end of each period.

The mortgage loan from a savings and loan institution. The use of a bank credit card to make a purchase. Closed-end credit includes debt instruments that are acquired for a particular purpose and a set amount of time.

A Single lump sum of credit B An installment loan for purchasing furniture C A mortgage loan D A department store. How an Installment Loan Works. An open-end loan for example a credit card is a pre-approved loan between a financial institution and a borrower that can be used repeatedly up to a certain limit and then paid back before payments are due.

An example of open-end credit is aautomobile loans binstallment sales credit cmortgage loans drevolving check credit 11. To understand it better a line of credit as used in the. The lender provides the borrower an amount equivalent to the cost of the motor vehicle.

Open End Credit This is a type of credit loan paid on installments in. Credit enables people to purchase goods or services using borrowed money. In other words the borrower has the right to tap into the credit made available to.

Installment credit in which the debt is repaid in equal installments over a specified period of time exploded on the American scene with the advent of the A Train. Such loans usually come with a loan duration of 12 months to 60 months or more depending on the lender and the loan amount. A closed-end loan is frequently an installment loan in which the loan is issued for a specific amount and repaid in installment.

A buy down c. High-Interest installment loans should be used for short-term financial needs only not as a long. If you take out an installment loan such as an auto loan this is a form of closed-end credit with a fixed interest rate and payment.

E the use of a bank credit card to make a purchase Mortgage loans automobile. An open end loan also known as a line of credit or a revolving line of credit is a type of loan where the bank offers credit to the borrower up to a certain limit and giving the borrower the freedom to use the amount of credit it needs whenever it is needed. A good example of an open-end credit is.

A mortgage loan from a savings and loan institution. Installment loan for purchasing a major appliance. Most companies that offer open-end credit will check a FICO credit score as part of their underwriting.

Depending on the product you use you. View Test Prep - Open End Credit examples from MATH 140 at Colorado Technical University. Types of Installment Loans.

The use of a bank credit card to make a purchase. An example of conventiona. A borrower may repay the balance before the payments are due and the loan is usually smaller than a closed-end loan.

What are three examples of installment credit. A installment loan from a furniture store.

Types Of Credit Definitions Examples Questions

What Is Open End Credit Experian

Lesson 16 2 Types Sources Of Credit Ppt Download

5 Benefits Of Open Banking For Consumers Belvo

Lesson 16 2 Types Sources Of Credit Ppt Download

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

Revolving Debt Vs Installment Debt What S The Difference

Accepting Card Payments In Installments Stripe Documentation

Lesson 16 2 Types Sources Of Credit Ppt Download

How To Read Your Credit Card Statement Rbc Royal Bank

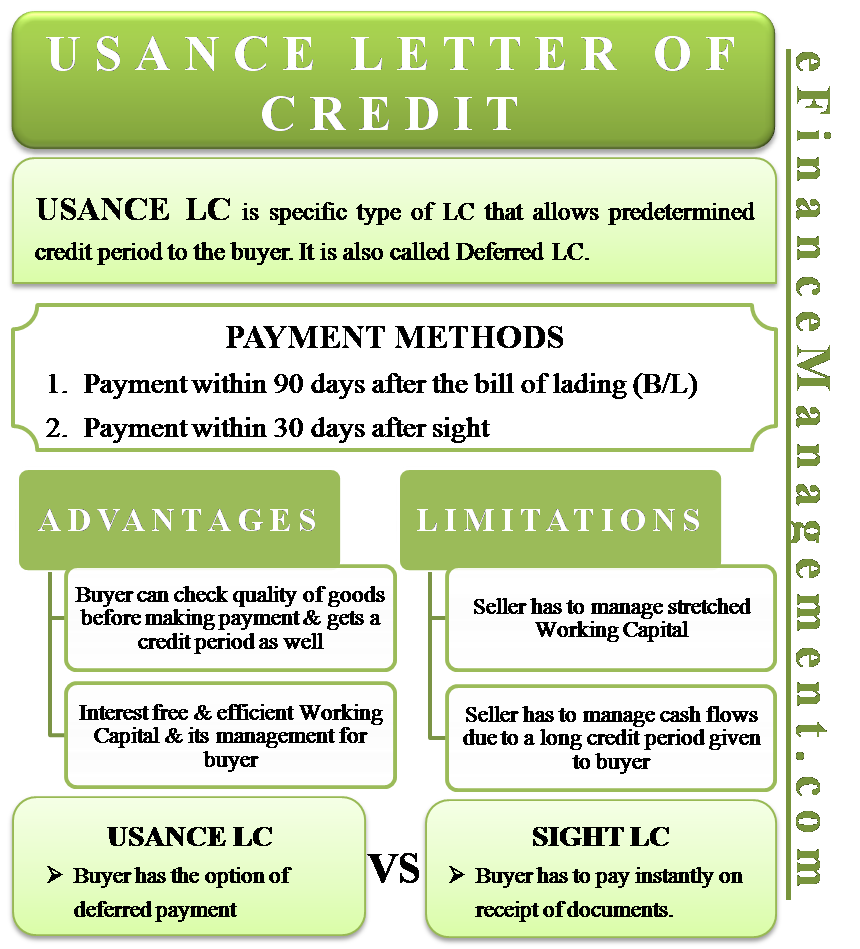

Usance Letter Of Credit Meaning Example Sight Vs Usance

What Are Three Types Of Consumer Credit

Lesson 16 2 Types Sources Of Credit Ppt Download

Credit The Four Most Common Forms Christian Credit Counselors

Revolving Credit Vs Installment Credit What S The Difference

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

What Are Three Types Of Consumer Credit

13 1 Compound Interest Simple Interest Interest Is Paid Only On The Principal Compound Interest Interest Is Paid On Both Principal And Interest Compounded Ppt Video Online Download

/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)